🔥 This offer expires in:

🔥 This offer expires in:

For Anyone Who Feels Stuck, Overwhelmed, and Ready to Take Control of Their Money with Simple, Proven Strategies

What School Never Taught You About Money: The Strategy to 10x Your Wealth Building & Start Turning Saving Into Financial Freedom

Without working endless overtime, stressing over complicated investment strategies, or needing a finance degree or expensive advisor to get started—this guide reveals the simple wealth-building strategies the top 1% already know. The Investment Edge 10x Wealth Blueprint is your step-by-step roadmap to making your money work for you, no matter your starting point.

TRENT F.

TEACHER, COACH & COUNSELOR

The investment Edge is a game changer! It helped me understand my finances and how to get my debt under control. Because of the steps and strategies within this ebook, I went from a 650 credit score all the way to 813! You don't want to miss The Investment Edge -- GET IT NOW!

INTRODUCING THE INVESTMENT EDGE

44% of People Aged 28-43 Claim to Have Investment Knowledge, Yet Most Still Live Paycheck-To-Paycheck

Are You Working Harder Than Your Money?

Every day, millions of people put in long hours, only to feel like they’re barely getting ahead. You work hard, pay your bills, maybe save a little—but no matter how much effort you put in, it feels like you’re stuck in the same financial cycle.

The average American has $90,000 of debt. The problem isn’t how hard you work. It’s that most of us were never taught how to make our money work for us. Without basic financial knowledge, it’s easy to fall into the paycheck-to-paycheck trap, feeling overwhelmed, confused, and afraid of making costly mistakes.

This guide changes that. You’ll discover simple, proven strategies to take control of your finances, grow your wealth, and finally feel confident about where your money is going. No complicated jargon. No guesswork. Just clear, actionable steps to help you break free from financial stress and start building the life you deserve.

10x Your Wealth Building

Leaving your money in a savings account earning less than 1% interest is actually losing you money over time. The average savings account rate is just 0.46%, while inflation eats away at your purchasing power. Learn how smart investing can grow your money exponentially, turning small steps today into big wealth tomorrow—no finance degree required

Get Clarity

Nearly 40% of non-investors avoid investing because they feel uneducated about the process, and 70% say they’d invest more if they had better financial education. This eBook cuts through the noise, breaking down money management into easy, actionable steps so you know exactly what to do to reach your financial goals

Feel Financially Empowered

When you understand money, you control it—not the other way around. Financial illiteracy costs the average person $1,389 per year. That’s money slipping through your fingers without you even realizing it. This guide equips you with the knowledge to stop losing money, start making smarter decisions, and feel confident taking control of your financial future.

Start Seeing Results

As of 2023, 25% of US adults fail basic financial literacy tests. That gap in knowledge keeps people stuck in the same financial rut. This eBook isn’t just about learning—it’s about doing. You’ll get the tools and strategies you need to break free from financial stress and finally see real progress in your wealth and personal life.

MORE THAN JUST A PDF

Knowledge is power. Introducing your superpower...

Right after your purchase, you'll receive the links to the Investment Edge eBook and your free Advanced Budget Tracker spreadsheet

The Investment Edge: Build Wealth 10x Faster Without Working Harder

Here's the eBook content:

Introduction: Breaking Free from Financial Confusion

Chapter 1: Rewiring Your Money Mindset

Chapter 2: Financial Foundation Essentials

Chapter 3: Making Money Work For You

Chapter 4: Wealth Acceleration Strategies

Chapter 5: Implementation and Growth

Conclusion: Your Wealth Building Journey

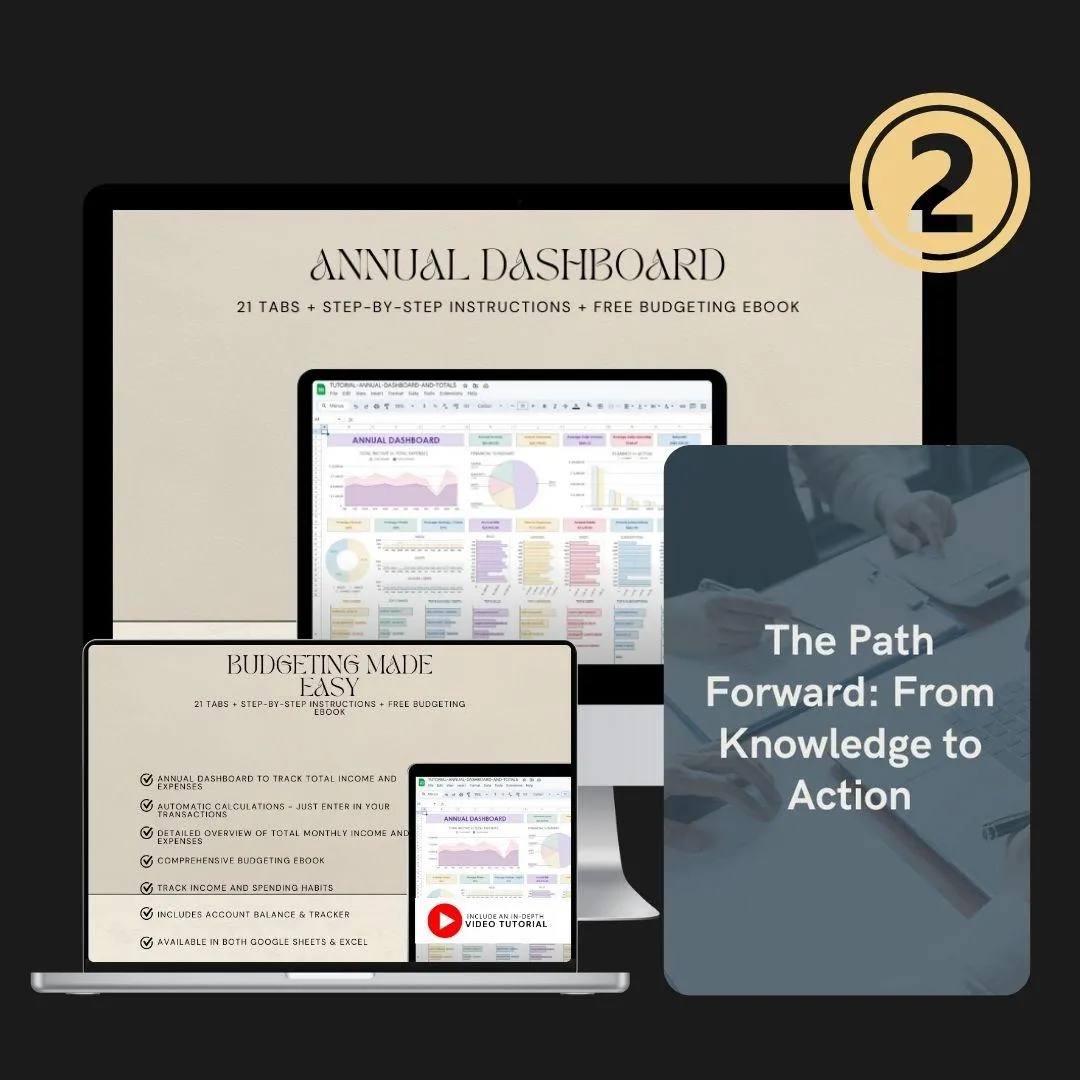

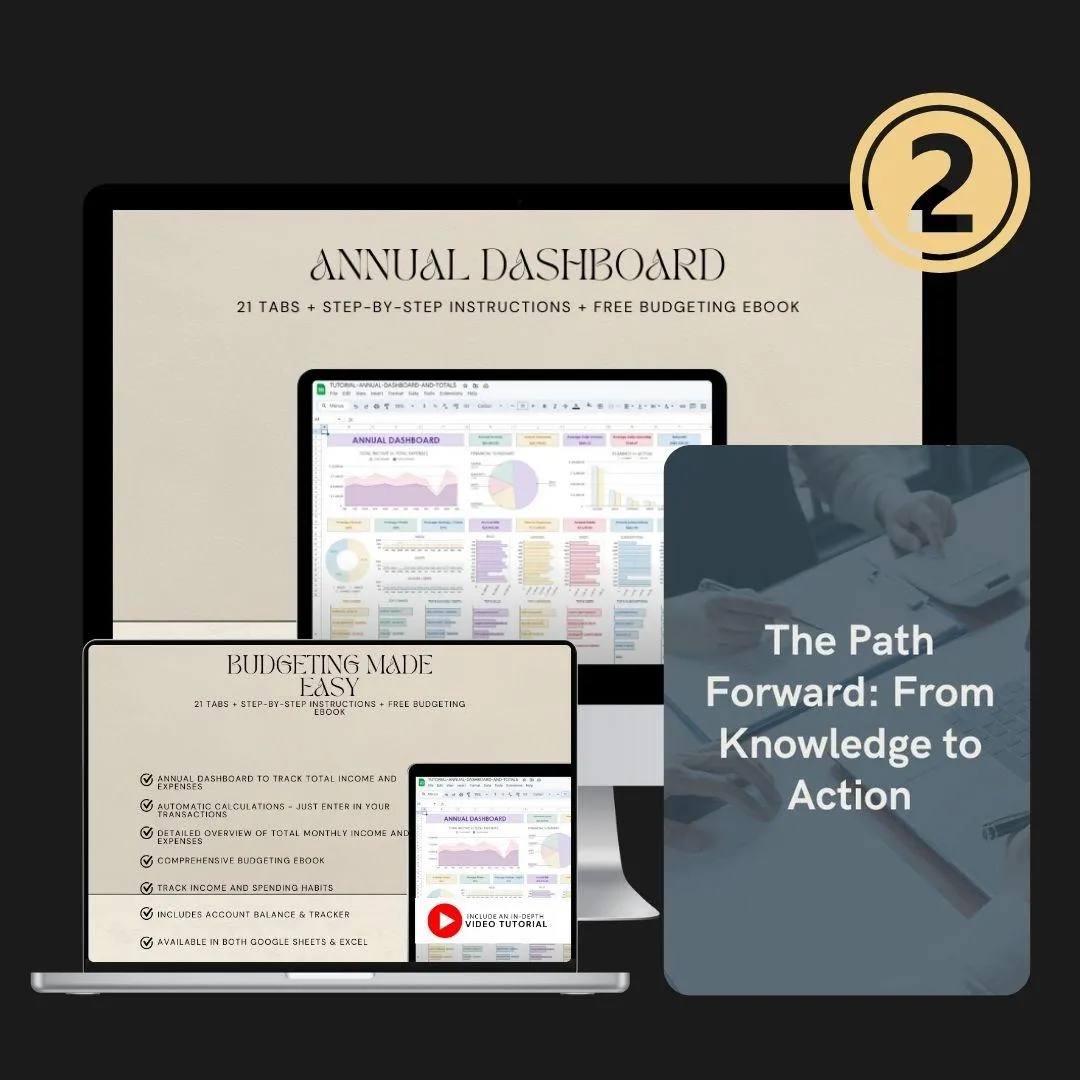

FREE BUNDLE: Annual & Monthly Expense Trackers and Budgeting Tool

This bundle includes:

Annual Dashboard

Automatic Calculations

Detailed Overview of Monthly Income and Expenses

In-Depth Video Tutorial

Track Income and Spending Habits

Available in Both Google Sheets & Excel

Exclusive Extras Just For YOU!

Along with the eBook and Free Annual and Monthly Budget Tracker Bundle, get special included extras that turbocharge your success. These are designed to complement your learning and give you an edge in transforming your financial future. Act now to unlock these invaluable tools!

BONUS 1: 30-Day Money Mindset Action Plan

Break free from old money habits with a simple, daily plan designed to shift your mindset and set you up for financial success in just 30 days.

BONUS 2: 30-Day Money Mindset Habit Tracker

Good habits build wealth—this tracker helps you stay consistent, spot what’s working, and keep your progress on track.

BONUS 3: The Essential Money Mindset Bookshelf

Fast-track your financial growth with a curated list of 35 powerful books that will challenge how you think about money—and inspire smarter decisions.

BONUS 4: Income Analysis & Expense Tracking Worksheet

Gain instant clarity on your finances with an easy worksheet that helps you manage your money smarter and spot opportunities to save.

BONUS 5: 12-Month Wealth-Building Roadmap

Stop guessing and start growing—this step-by-step roadmap shows you exactly how to build wealth with focus and confidence over the next year.

BONUS 6: 47 Ideas to Optimize Your Income & 33 Ideas To Reduce Spending

Discover over 80 practical ideas to boost your income and cut costs without feeling like you’re sacrificing your lifestyle.

READY TO GET STARTED?

Get The Investment Edge PDF Today!

With the bundle, you gain immediate access to invaluable resources on how to beat the banks and take control of your financial future. For a limited time, grab this comprehensive package at an unbeatable price. Don’t miss this chance to transform your future and join the top 1%.

INVESTMENT EDGE PDF

$37 USD

Tax Included

Full 93 Page Investment Edge PDF.

FREE: Annual and Monthly Budget Tracker Bundle

With included In-Depth Video Tutorial.

BONUS 1: 30-Day Money Mindset Action Plan

Break free from old money habits with a simple, daily plan designed to shift your mindset and set you up for financial success in just 30 days.

BONUS 2: 30-Day Money Mindset Habit Tracker

Good habits build wealth—this tracker helps you stay consistent, spot what’s working, and keep your progress on track.

BONUS 3: The Essential Money Mindset Bookshelf

Fast-track your financial growth with a curated list of 35 powerful books that will challenge how you think about money—and inspire smarter decisions.

BONUS 4: Income Analysis & Expense Tracking Worksheet

Gain instant clarity on your finances with an easy worksheet that helps you manage your money smarter and spot opportunities to save.

BONUS 5: 12-Month Wealth-Building Roadmap

Stop guessing and start growing—this step-by-step roadmap shows you exactly how to build wealth with focus and confidence over the next year.

BONUS 6: 47 Ideas to Optimize Your Income & 33 Ideas To Reduce Spending

Discover over 80 practical ideas to boost your income and cut costs without feeling like you’re sacrificing your lifestyle.

Still Got Questions?

Here Are The Answers

What exactly will this guide teach me?

This guide will teach you how to make your money work for you instead of working for money. You'll learn the foundations of building wealth, smart investing strategies, and step-by-step how to grow your returns without working harder. It covers everything from financial literacy basics to advanced wealth-building techniques, including budgeting, passive income creation, and investment portfolio management.

Is this guide suitable for beginners?

Absolutely. This guide is perfect for beginners. It breaks down complex financial concepts into simple, easy-to-understand steps. Whether you’ve never invested before or feel overwhelmed by financial jargon, this guide provides clear explanations and actionable strategies to help you start building wealth with confidence.

Do I need a large amount of money to start?

Not at all! The guide shows you how to begin investing with as little as $50 per month. It focuses on smart strategies like micro-investing, fractional shares, and low-cost index funds, allowing you to grow your wealth even if you’re starting small.

How quickly can I see results?

Some changes, like avoiding low yield savings accounts and investments, can bring instant savings, while other wealth-building strategies work over time. Results can vary depending on your starting point and how consistently you apply the strategies. Some people see changes in their financial mindset and habits within weeks, while noticeable growth in investments may take a few months. The guide emphasizes both short-term wins and long-term wealth-building strategies.

Will this guide work for me if I’m already investing?

Absolutely. If you're already investing, this guide can help you optimize your portfolio, identify new growth opportunities, and improve your wealth-building strategies. It covers advanced topics like tax-efficient investing, diversification, and passive income streams to help you maximize your returns.

What resources come with the guide?

Along with the main guide, you’ll get a 12-month wealth-building roadmap, net worth calculators, investment tracking templates, budgeting worksheets, passive income strategies, action plans and milestone checklists, and a list of top tools, book recommendations. These resources are designed to help you implement what you learn quickly and effectively.

How is this different from free advice I can find online?

Great question! While free advice online can be helpful, it’s often scattered, inconsistent, and overwhelming. This guide brings everything together in one place, with actionable steps and insider strategies that are often scattered across multiple sources. We’ve condensed years of financial wisdom into a structured, step-by-step system backed by research and real-world success stories. It eliminates guesswork, helps you avoid common mistakes, and focuses on proven strategies that actually work.

Is there a guarantee if I’m not satisfied?

While we can’t offer refunds on digital products, we’re confident in the value this guide brings. The strategies inside are designed to help you save and grow your money—many users report getting more than their money’s worth within days of implementing the tips.

All rights reserved LevelUp Investing Academy

Disclaimer:

This guide is provided for informational purposes only and does not constitute financial, investment, or legal advice. The content is based on research and personal experience and is intended to share general information about financial concepts and strategies. Individual financial situations vary, and it’s important to consult a qualified financial advisor before making any investment or financial decisions. We do not guarantee specific results, and all investments carry risk. The creators and distributors of this guide are not responsible for any losses or damages resulting from actions taken based on its contents.